Tax Document Understanding

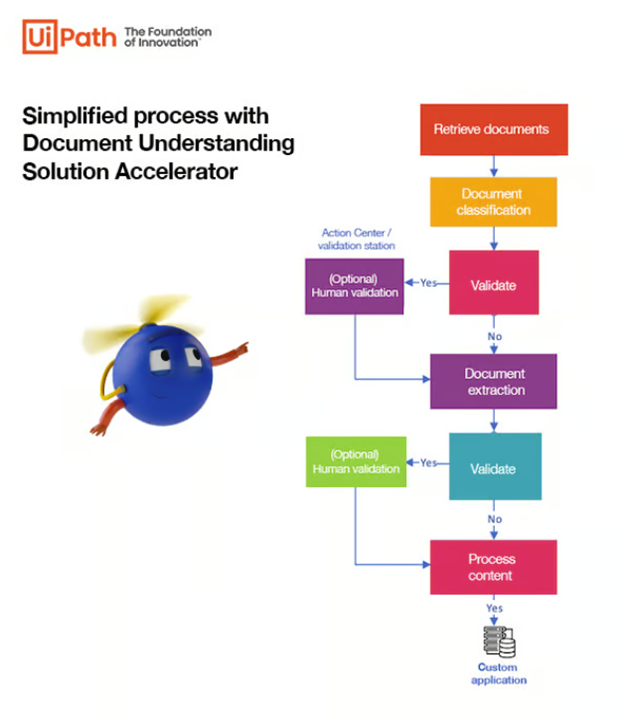

The UiPath Business Automation Platform simplifies AI-powered automation development for organizations, with Solution Accelerators expediting the process. These accelerators provide comprehensive technical packages based on best practices.

This specialized collection of Solution Accelerators optimizes the extraction and validation of critical data from U.S. financial and tax documents such as Form I-9, payslips, Form 1040, invoices, Form W-9, and Form W-2. Designed for comprehensive information retrieval from these essential records, the solution leverages the superior AI capabilities of UiPath Document Understanding. This guarantees heightened precision in financial and employment data management, enabling businesses to ensure compliance, streamline tax and wage reporting, and enhance operational efficiency.

Elevate accuracy in U.S. financial and tax data extraction

This collection processes crucial data from U.S. financial and tax documents. For Form I-9, it draws out specifics like Employee Identity, Eligibility Status, and Verification Details. For IRS Tax Form 1040, it gleans details such as Income Sources, Deductions, and Tax Credits. This comprehensive methodology ensures precise tracking and validation of financial information across multiple forms, underpinned by an agile and robust architecture.

Accelerating AI-powered automation

UiPath Solution Accelerators are prebuilt modular frameworks that streamline AI-powered automation projects by reducing discovery, design, and development phases. They offer ready-to-use resources and adapt seamlessly to various systems and applications. Customizable and efficient, these accelerators help organizations save time and expand their automation initiatives while following best practices.

6 listings

Best-in-class listings for Tax Document Understanding