Intelligent Mortgage Processing

by qBotica Inc

0

Partner Solution

Summary

Summary

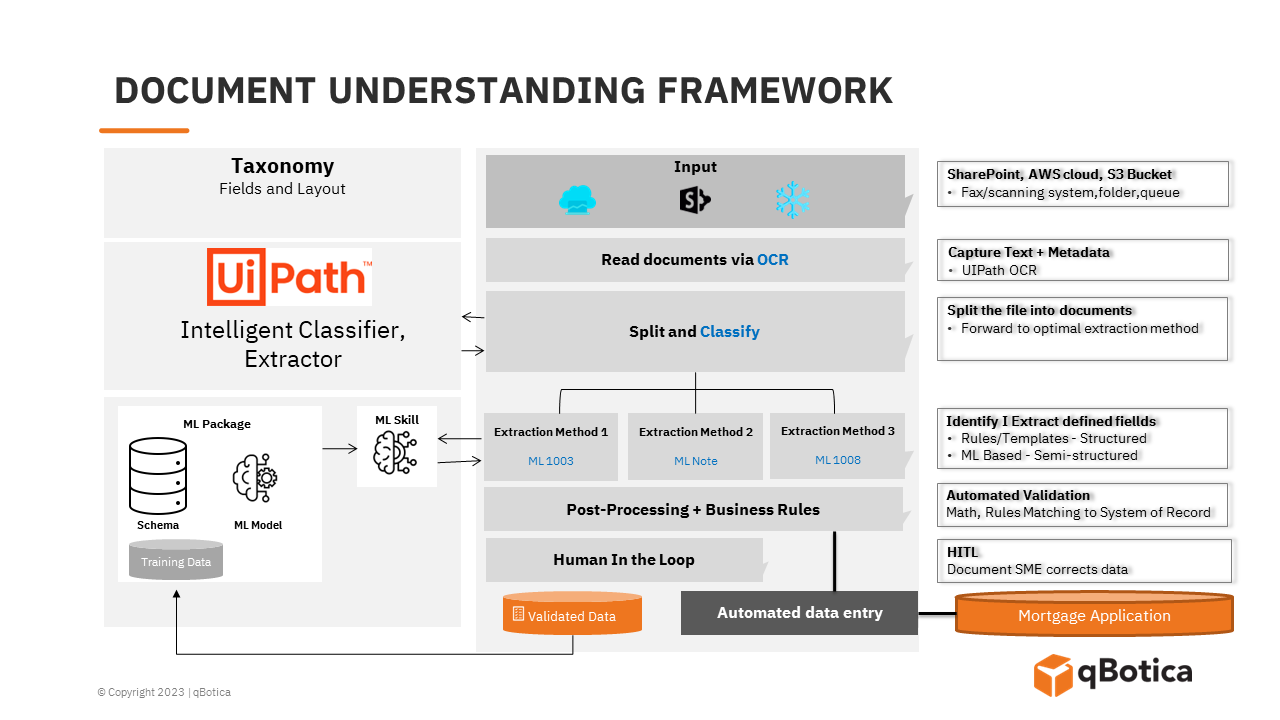

The Intelligent Mortgage Solution classifies consolidated mortgage documents into specific document types, extracts data, and feeds it into the Mortgage Application.

Overview

Overview

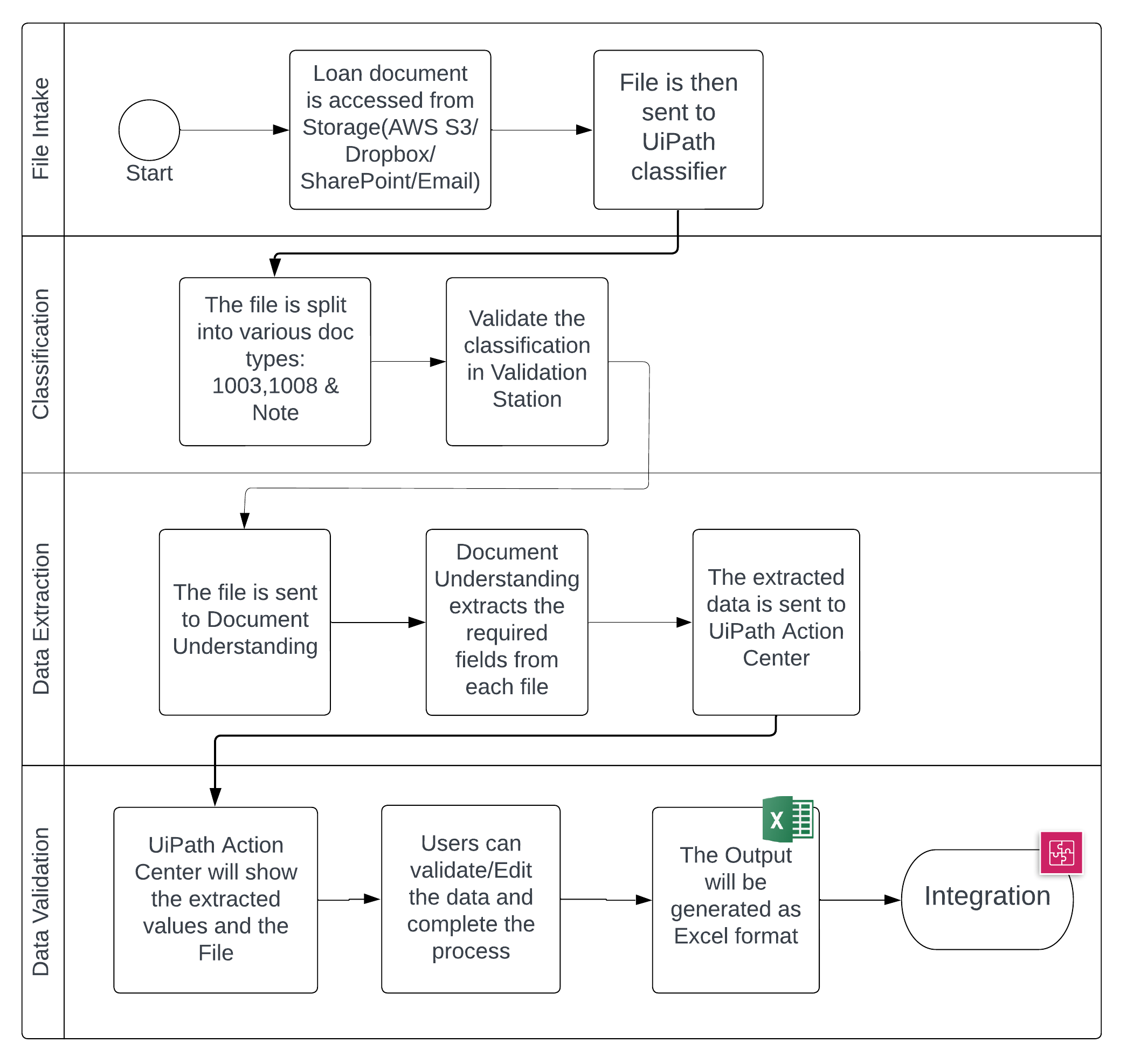

Intelligent Mortgage Solution offers a streamlined solution for business users seeking to extract data from mortgage documents within consolidated loan documents. With this solution, the original loan document is classified into various document types, 1003 (Uniform Residential Loan Application (URLA) form), 1008 (Transmittal Underwriting Summary), and Promissory Note, and extract valuable golden data from these files. The extracted data is then seamlessly fed into the Mortgage Application for further processing.

- File Intake: The solution supports flexible file intake options, allowing users to access loan documents from local storage or popular cloud storage platforms such as AWS S3, Dropbox, SharePoint, Email, and more.

- Classification: The original loan document undergoes advanced classification to identify the specific document types (1003, 1008, Promissory Note).

- Data Extraction: Using UiPath Document Understanding, the solution automatically extracts the golden data from the classified and split files. This data is intelligently compiled into an Excel file, providing a structured format for further analysis and processing.

- Data Validation: Includes the UiPath Action Center, allowing users to validate the extracted data with ease, ensuring accuracy and reliability.

- Integration with Mortgage Application: To complete the workflow, the borrower details extracted from the mortgage documents are seamlessly integrated into the Margill Loan Manager.

Scalability

- Additional mortgage documents can be seamlessly integrated into the solution with minimal configuration.

- In addition to the Margil Loan application, the solution supports the inclusion of these other mortgage applications such as Sagent and Black Knight applications.

Features

Features

- Automatically identifies the document type based on its text.

- This integration streamlines the data flow, eliminating manual data entry and reducing errors.

- Easy integration with existing workflows.

- The Mortgage Application can be customized according to the specific requirements of the users.

Additional Information

Additional Information

Dependencies

UiPath Robot License UiPath Document Understanding License Margill Loan Manager subscription

Technical

Updated

September 21, 2023Verification

Partner Solution Verified

Support

Phone: +1 (309) 291-1709

Email: arunkumar.a@qbotica.com

Link: https://qbotica.com48 hours

Resources