Create your first automation in just a few minutes.Try Studio Web →

Know Your Customer AI

by UiPath

0

Solution

<100

Summary

Summary

KYC 1 automatizes the onboarding and monitoring process of KYC for financial institutions by using reliable, independent source documents and data about the clients registered in UK and France

Overview

Overview

Background

KYC or "Know your customers" refers to due diligence activities that financial institutions and other regulated companies perform to prevent them from being used by criminal elements for money laundering activities. This is a tedious and manual activity, requiring very accurate results. In case of mistakes the fines are of millions of USD and affects the reputation of the bank.

The 3 Key elements of KYC Policies:

Onboarding the customer – A smaller number of prospect clients need to be analyzed, but there is a pressure from competition on the SLA for client opening account.

Monitoring the customer data – The whole portfolio needs to be assessed periodically, with no pressure from the client, but from the regulations in this area (example: The frequency of a periodic review may increase (from 1 per 3 years to smaller periods) which almost triples of the volume of work

Monitoring of Transactions – Anti-Money Laundering activities (different process - out of scope)

Solution description

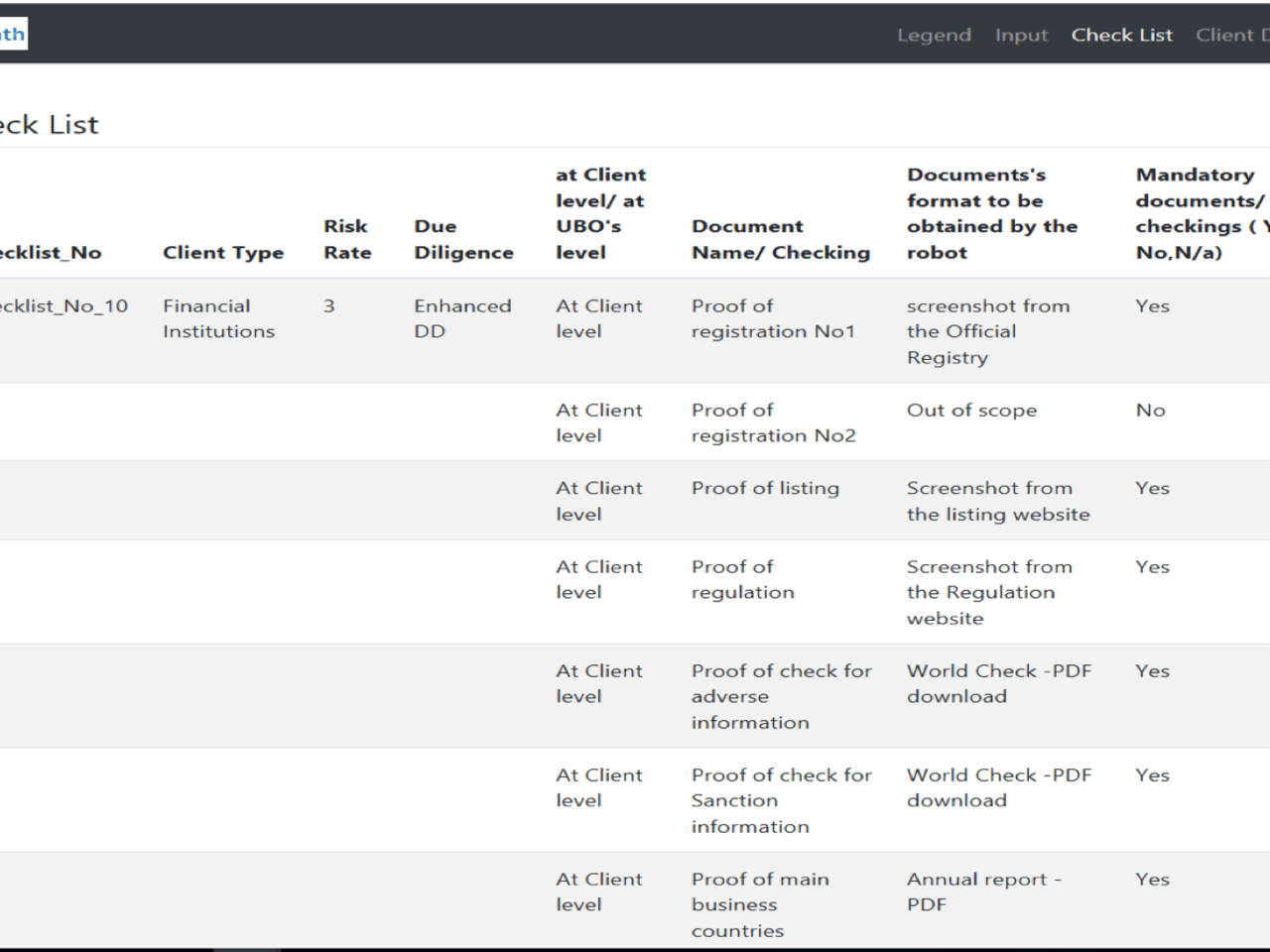

The solution is build around 7 sub-processes common to Onboarding/reviewing Corporate Clients in any Financial Institution performing the KYC for UK & France Customers

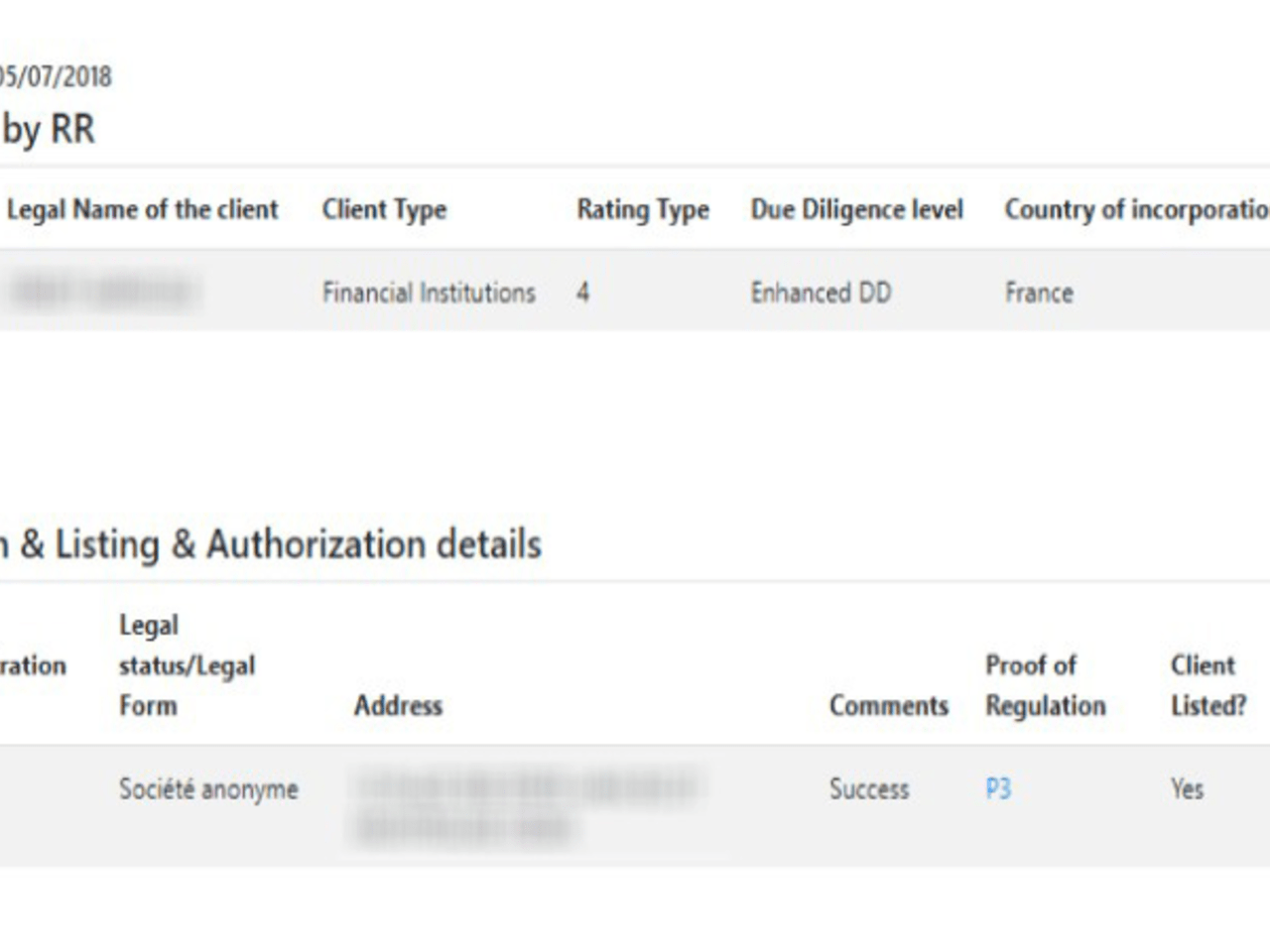

Proof of registration – like proof of identity for an individual, for a company it is meant to validate client name, client registration address and client registration number (Source of data*: France: Infogreffe, UK: Companies House)

Proof of listing – If a company is listed or not on a Stock Exchange; this also gives an important info about how supervised the customer is (Source of data*: France: Euronext, UK: London Stock Exchange)

Proof of regulation – financial institutions need to be authorized to perform activities in their area (Source of data*: France: acpr.banque-france.fr/ UK: www.bankofengland.co.uk)

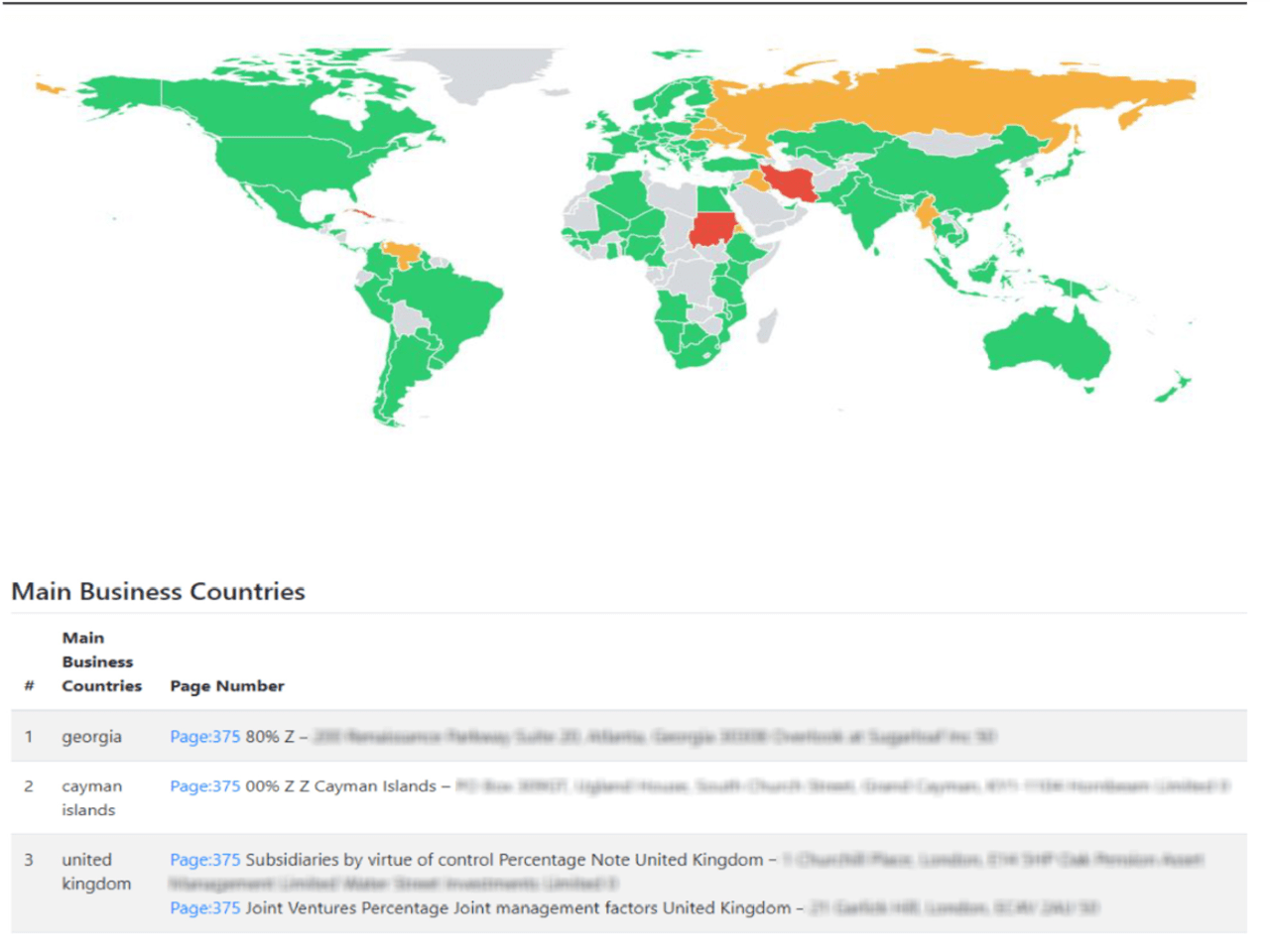

Main countries of business – Countries where the customers are developing their business (Source of data*:Annual report published on the companies site)

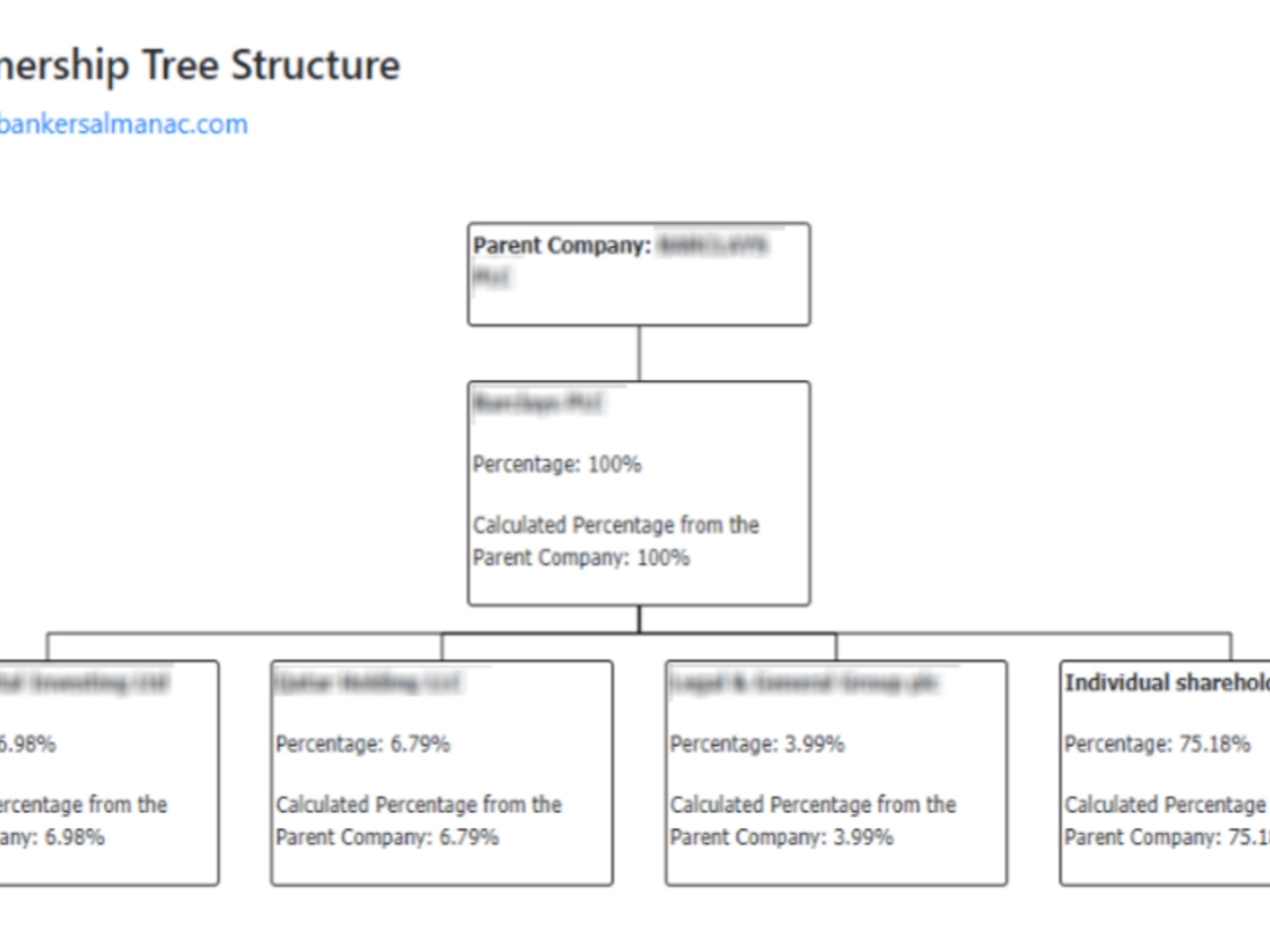

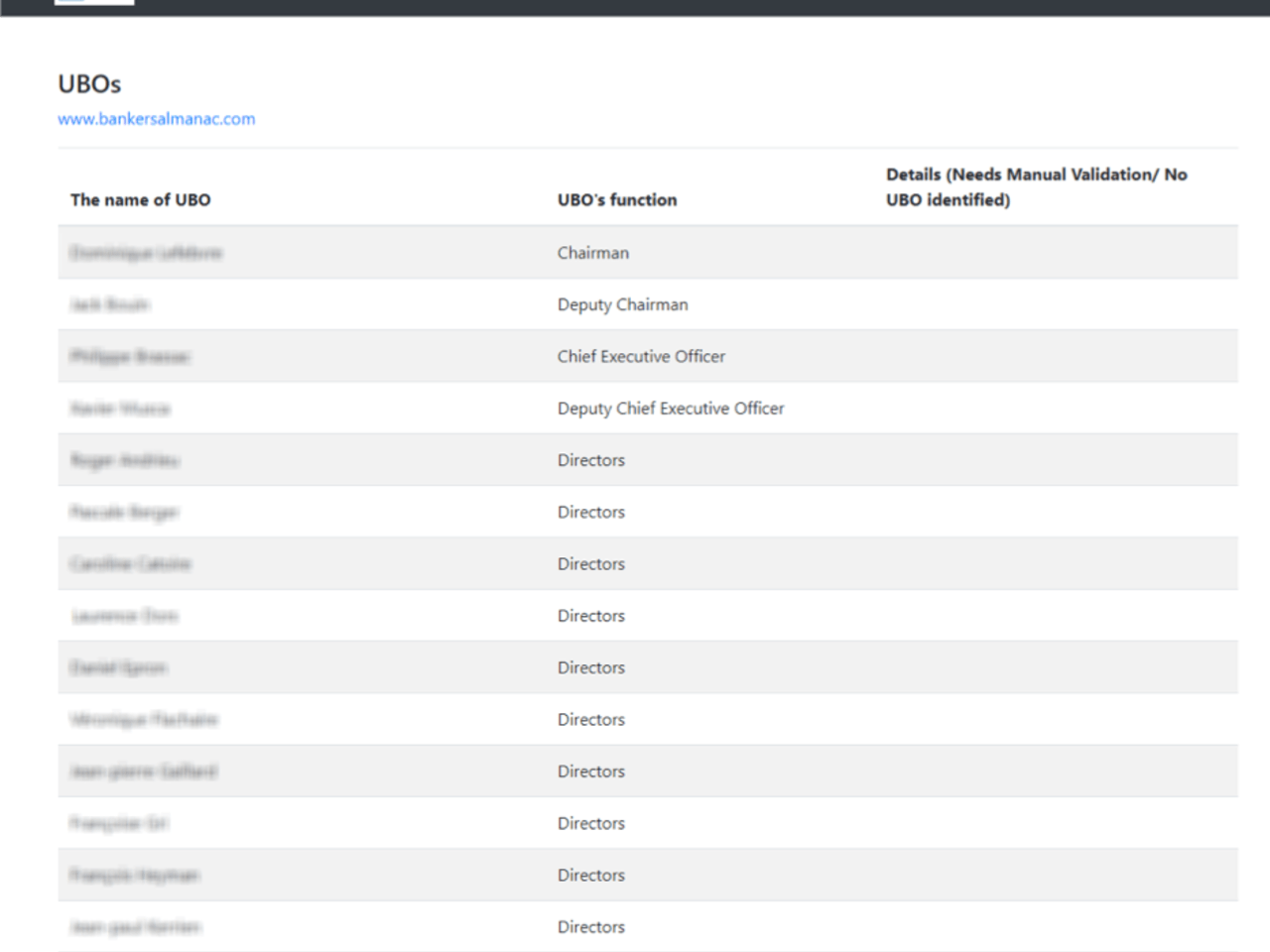

Management structure – Board of Directors (Source of data*: Bankers Almanac application that can be used by all banks, regardless of the counterparts’ country)

helps banks comply, in their due diligence, in relation with their counterparts

provides access to 114,569 documents for 20,415 financial institutions worldwide, together with other valuable information including details on ownership, group structures and regulators

Ultimate beneficial owner* – Who ultimately controls the company based on a predefined shareholder structure schema (Source of data*: Bankers Almanac application)

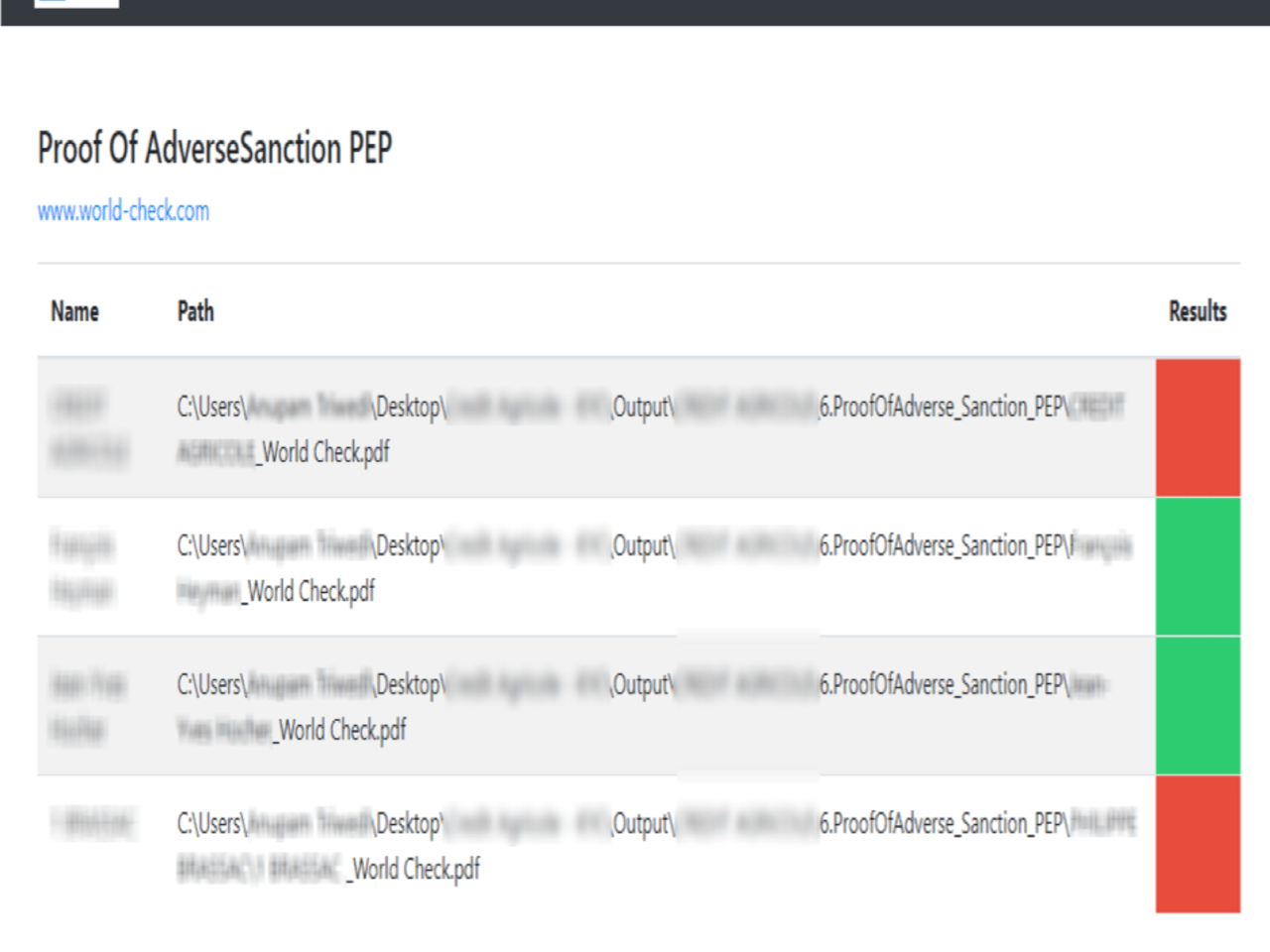

Screening on Adverse, Sanctions, PEP international lists – screening of information focused on PEPs and heightened risk individuals and entities, their associates, partners, families and extended networks (Source of data: World Check, that shows one consolidated report for each individual/entity, that presents the sanction or watchlist information alongside any additional negative media that is uncovered)

Part of the Thomson Reuters Risk Management Solutions suite it is presently used by:

- 49 of the world's top 50 banks

- 9 of the Top 10 global law firms

- 300+ Government agencies

*Solution includes for now UK & France for Customer Type - Financial Institutions. Next version will be updated with more countries and different customer types, other than Financial Institutions

Solution components – UiPath Custom UI Activity for the output display (.Net, HTML, JavaScript, CSS, Bootstrap)

- UiPath Pre-built Activities for all the repetitive tasks

- UiPath Custom NLP Activity **(**Python & nltk.)

- UiPath Custom ML Activity ("Naive Bayes Machine Learning Algorithm")

Combining Industry Knowledge (well documented business rules with the support of one major Bank) with RPA - UiPath Platform functionalities - and Computer Vision + Natural Language Processing and Machine Learning algorithms, we obtained a solid plug and play solution that can be used at industry level & not only.

Features

Features

FTE Saving - continuous increase of volumes due to the business growth and Compliance Regulations Increases the quality of the process & reduce the operational and reputation loss risks. In case of errors, the fines can go up to Millions of $

Additional Information

Additional Information

Dependencies

UiPath Studio MS Excel MS Word Internet Explorer v11