omni:us - Claim Processing

by omni:us

0

ML Model

<100

Summary

Summary

Supercharge your claims processing times with semantic document classification & extraction

Overview

Overview

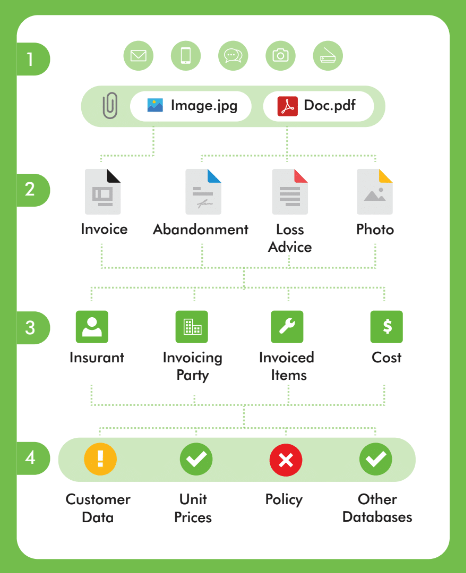

The claims settlement process in insurance is still a highly manual and costly process. Automation is difficult due to the high variability of documents, which are characterized by complex unstandardized structures. For high volume, low cost lines of business, insurers can make major savings by leveraging artificial intelligence systems to process their data.

This is where omni:us comes in - giving you a competitive edge by accelerating your claims process. Our AI seamlessly classifies and extracts crucial data from submitted documents.

The challenges of manually processed claims material:

Sheer volume: huge variation in document formats (emails, incident reports, invoices, etc.)

Low quality: scanned documents, faxes, handwriting

Multipage: various documents in single PDF require division

Complex: claim-to-policy matching, adjusting and validation is highly time consuming

omni:us is changing the status quo as we bring first hand applications of AI into the daily operations of insurers. See below the benefits we can offer.

Features

Features

omni:us classifies incoming claims documents and assigns them to virtual piles, where documents of the same kind are combined (health invoices, car repair invoices, theft reports, etc). From each pile, vital information is extracted, examined, and returned seamlessly to the client. Based on this crucial data, the client is empowered to rapidly make adjustment, remittance or denial decisions. The claims process is completed at a substantial cost saving to manual alternatives.

Additional Information

Additional Information

Dependencies

None.