Process Mining for Customer Onboarding

by Verdant Data

0

Partner Solution

Summary

Summary

Enhance the client onboarding by identifying bottlenecks and accelerating KYC and account setup.

Overview

Overview

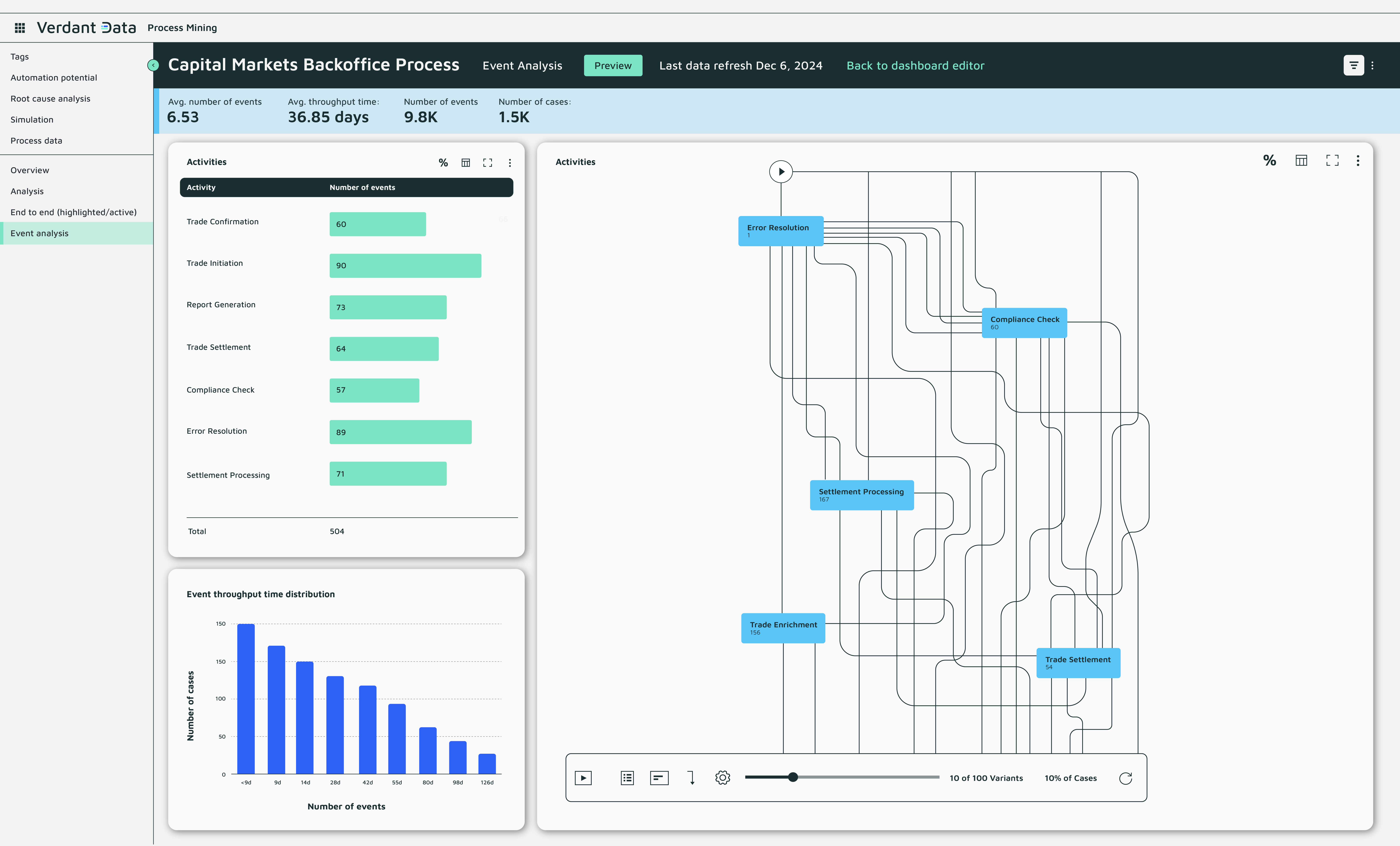

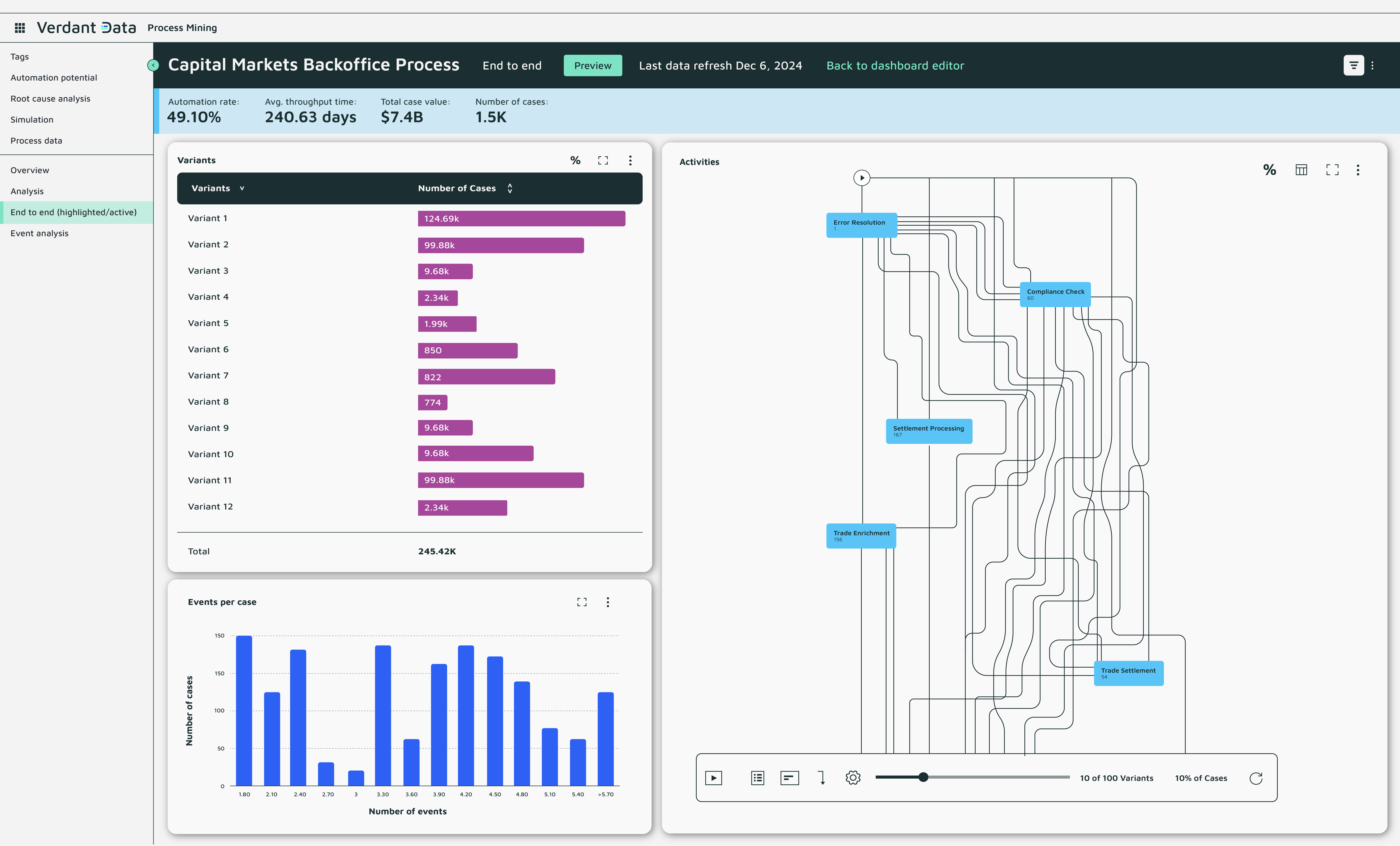

Client onboarding remains a key differentiator in banking and insurance, where the balance between fast account setup and strict regulatory compliance can be difficult to maintain. This app uncovers how onboarding journeys actually unfold, highlighting where customers encounter friction – whether in KYC verification, document submission, or account activation.

By integrating CRM, compliance, and core banking system data into UiPath Process Mining, banks gain a clear picture of customer onboarding times, rework loops, and potential risk exposures.

The app empowers onboarding managers, compliance officers, and process improvement leads to streamline customer experiences, reduce time-to-revenue, and improve adherence to KYC and AML regulations.

Note: The demonstration and walkthrough are free of charge.

Features

Features

The app solves the challenge of fragmented onboarding processes where customer data moves across disconnected systems and manual reviews create delays. It delivers clear benefits such as reduced onboarding time, improved compliance tracking, and a better overall customer experience.

With these insights, banks can target automation and process changes where they matter most. Organizations adopting the app typically shorten onboarding times by 25–35%, leading to faster revenue realization and higher customer retention.

End-to-End Process Visibility: Analyze onboarding across all channels — retail, private, and corporate — down to each subprocess.

Bottleneck & SLA Violation Detection: Instantly highlight stages where files sit too long or tasks are repeatedly reworked.

Multi-System Integration: Consolidate events from Salesforce, KYC tools, core banking, and ticketing systems for a single source of truth.

Customizable Dashboards & Views: Tailor process views for compliance, operations, and sales teams to track metrics most relevant to them.

Additional Information

Additional Information

Dependencies

This solution requires:

- UiPath Process Mining (Cloud or On-Premise)

- Access to relevant system data sources (ERP, Core Banking, CRM, or Policy Administration, depending on the process)

- SQL or flat file exports (CSV/Excel) for data integration

- UiPath Studio and Orchestrator for optional automation enablement

Technical

Updated

September 22, 2025

Verification

Partner Solution Verified

Application

Support

Email: support@verdantdata.ch

Link: https://www.verdantdata.ch/app-templates/client-onboarding-bankingVerdant Data provides standard support for this listing during business hours (09:00–17:00 CET, Monday–Friday, excluding public holidays). Support inquiries are typically responded to within 2 business days. Critical production issues are prioritized with same-day acknowledgement. Extended SLA and dedicated support options are available upon request.