Process Mining for Loan Origination in Banking

by Verdant Data

0

Partner Solution

Summary

Summary

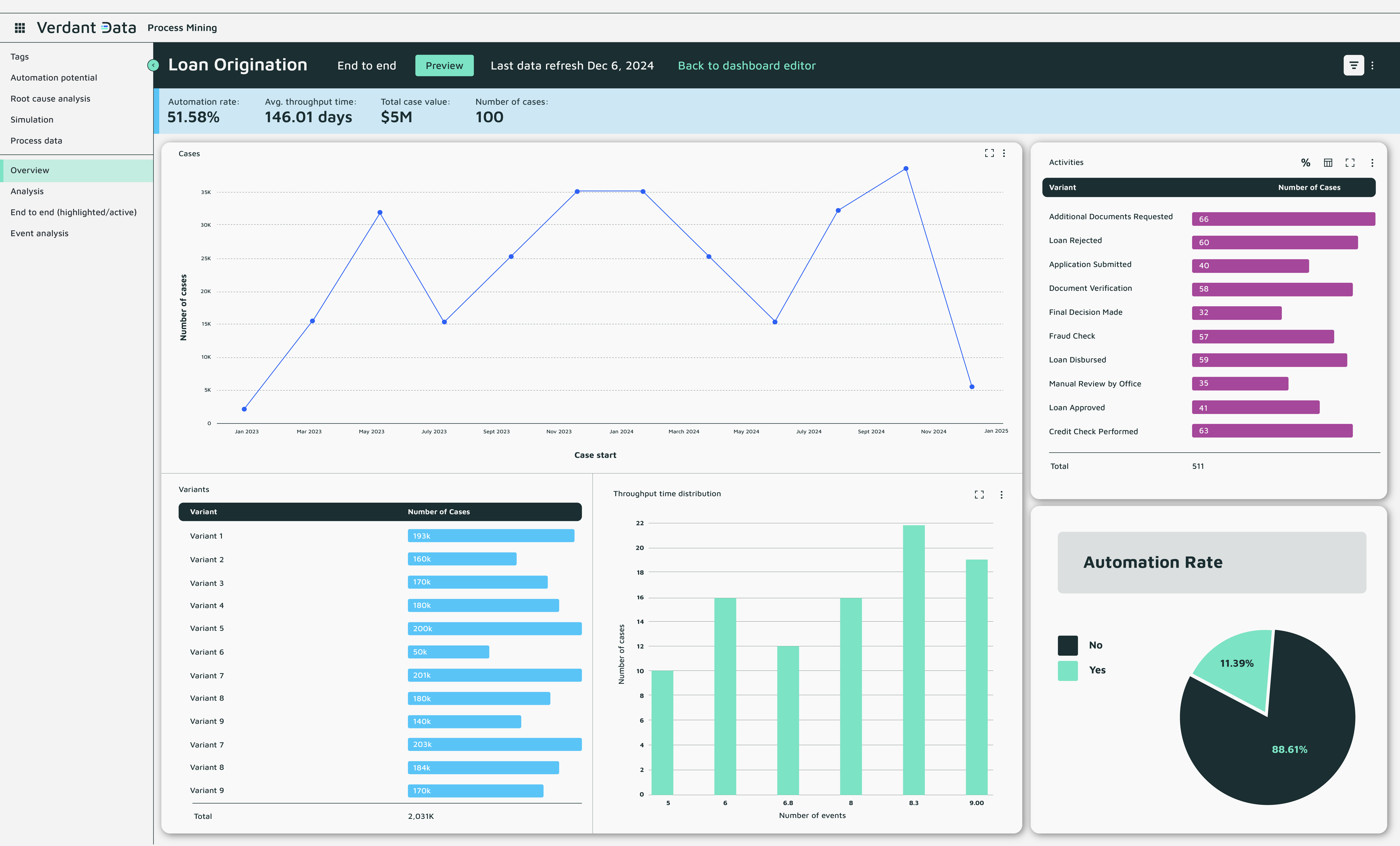

Analyze and optimize loan origination processes in banking to improve efficiency, reduce risk, and accelerate approvals.

Overview

Overview

Loan origination is one of the most critical processes in retail and corporate banking, but it is often slowed down by manual document reviews, multiple hand-offs, and regulatory checks.

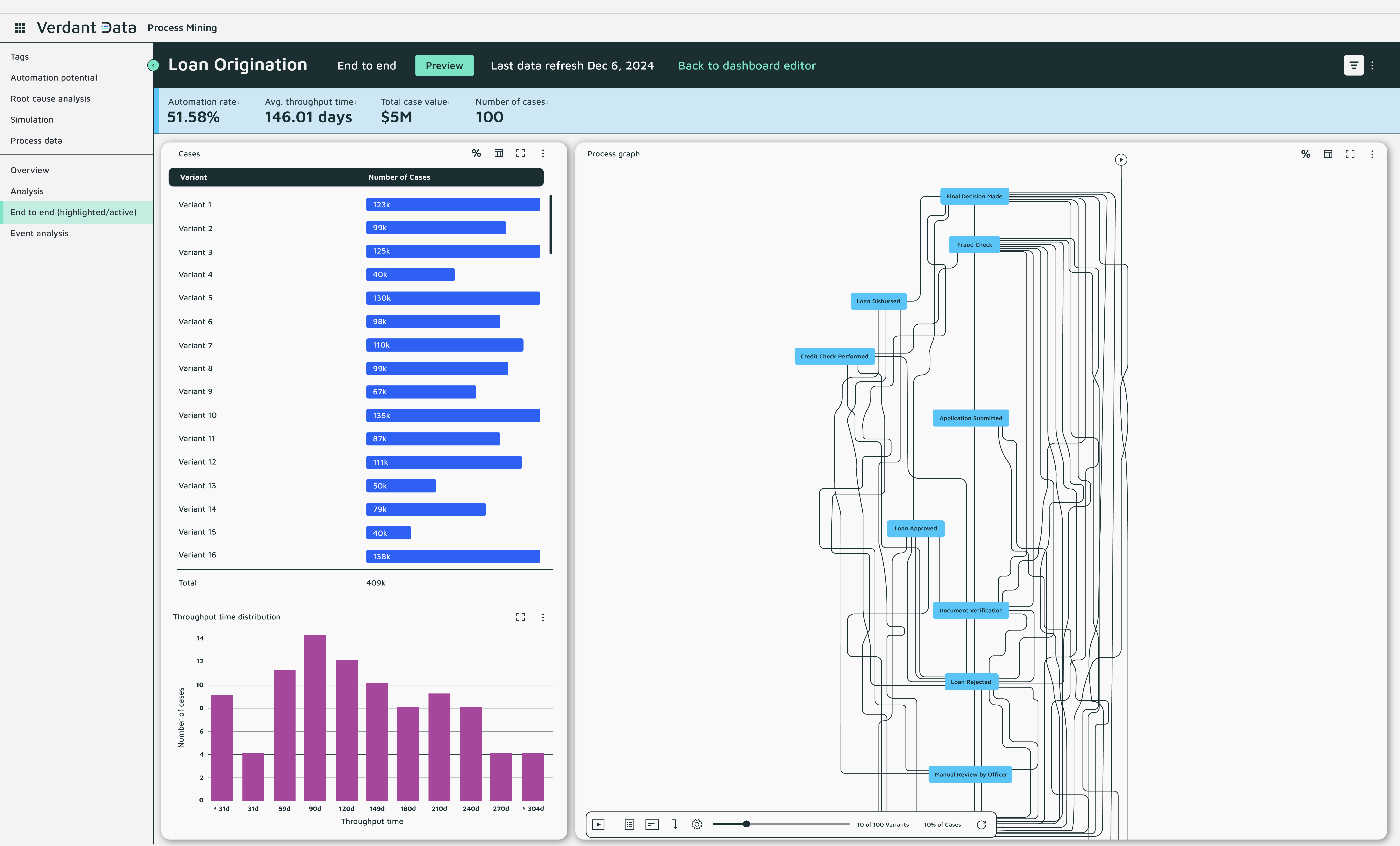

This app provides banks with complete transparency across the entire loan origination lifecycle – from initial application to final disbursement. By connecting data from core banking systems, document workflows, and compliance tools into UiPath Process Mining, financial institutions can identify where delays, rework, or compliance risks occur.

The result is faster decision-making, improved compliance, and a significantly better customer experience. The app is designed for operations managers, compliance leaders, and transformation teams seeking to shorten cycle times, reduce operational costs, and boost loan approval rates.

Note: The demonstration and walkthrough are free of charge.

Features

Features

This solution helps banks pinpoint the exact causes of loan origination inefficiencies, such as long document review times, repeated KYC checks, and manual exception handling.

With actionable insights, teams can redesign workflows, automate repetitive steps, and standardize compliance. Users benefit from reduced processing time, lower risk of regulatory breaches, and greater transparency in customer journeys.

On average, banks can achieve up to a 30–40% reduction in loan origination cycle times, directly translating into higher throughput and improved customer satisfaction.

End-to-End Transparency: Monitor the full origination process including onboarding, credit decisioning, and document verification.

Bottleneck Identification: Spot where applications stall or require rework, reducing cycle time and operational friction.

Compliance and Control: Ensure adherence to internal credit policies and regulatory obligations with audit-friendly process logs.

Scalable Framework: Adapt the app for retail, SME, or corporate loan products across different geographies.

Additional Information

Additional Information

Dependencies

This solution requires:

- UiPath Process Mining (Cloud or On-Premise)

- Access to relevant system data sources (ERP, Core Banking, CRM, or Policy Administration, depending on the process)

- SQL or flat file exports (CSV/Excel) for data integration

- UiPath Studio and Orchestrator for optional automation enablement

Technical

Updated

September 22, 2025Verification

Partner Solution Verified

Support

Email: support@verdantdata.ch

Link: https://www.verdantdata.ch/app-templates/loan-origination-bankingVerdant Data provides standard support for this listing during business hours (09:00–17:00 CET, Monday–Friday, excluding public holidays). Support inquiries are typically responded to within 2 business days. Critical production issues are prioritized with same-day acknowledgement. Extended SLA and dedicated support options are available upon request.