Create your first automation in just a few minutes.Try Studio Web →

VAT Validation Activities

by Pawel Wesolowski

0

Activity

231

Summary

Summary

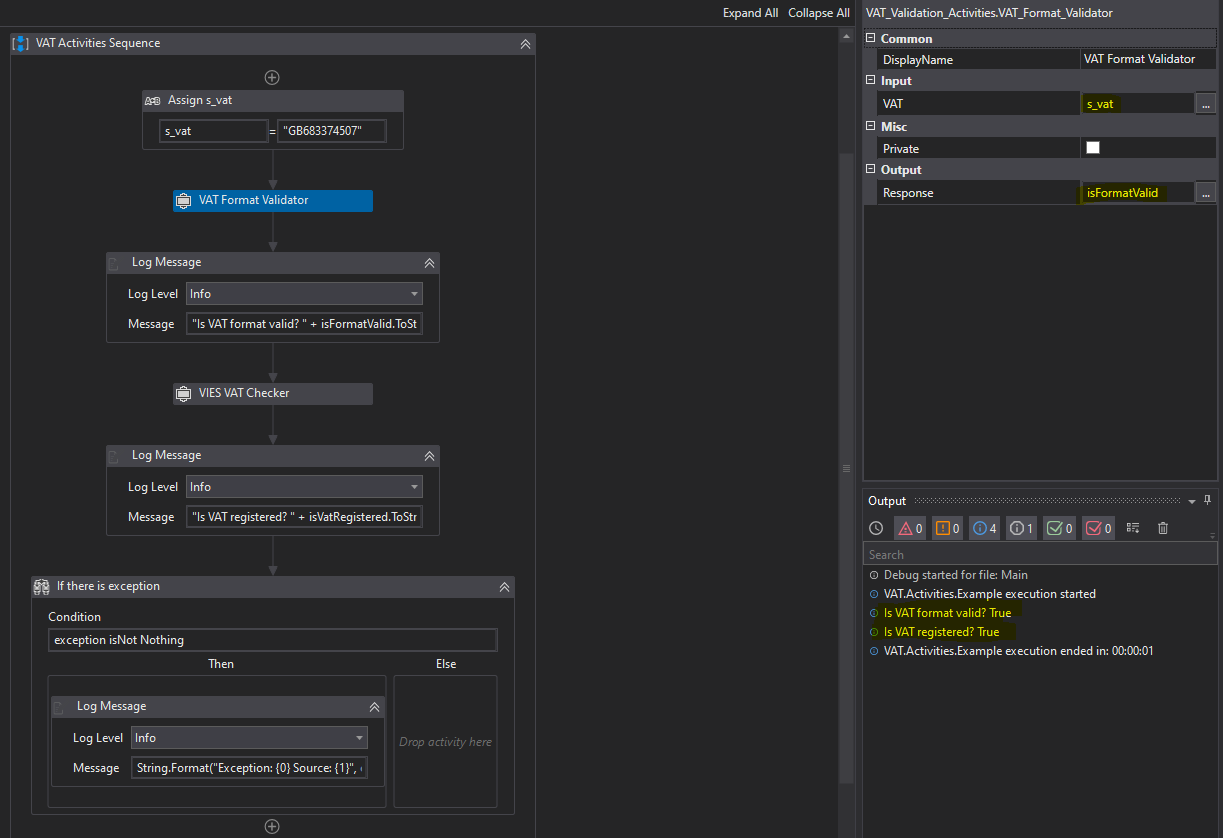

Two activities to validate EU VAT registration number (you can check if vendor/customer is VAT registered) and its format.

Overview

Overview

This package contains two activities:

1. VAT Format Validator - offline activity. Every country has well-known VAT number format/syntax. This activity uses these rules to check if the provided VAT number format is correct. It tells only if the format is correct, not if such VAT exists in the real world!

Works mainly for EU countries, full list below:

a. AT

b. BE

c. BG

d. CY

e. CZ

f. DE

g. DK

h. EE

i. EL, GR (Greece)

j. ES

k. FI

l. FR

m. GB

n. HU

o. IE

p. IT

q. LT

r. LU

s. LV

t. MT

u. NL

v. PL

w. PT

x. RO

y. SE

z. SI

aa. SK

+ HR for 1.2.0 release

2. VIES VAT Checker - online activity so connection with internet is needed. This activity uses European Commission VAT validator (VIES - https://ec.europa.eu/taxation_customs/vies/) to validate if such VAT number is registered. Works only for EU countries (no longer works for GB!).

Features

Features

You can easily and quickly validate VAT number (online) to check if vendor/customer is VAT registered or the VAT number format (offline).

Additional Information

Additional Information

Dependencies

No dependencies.

Code Language

Visual Basic

Runtime

Windows Legacy (.Net Framework 4.6.1)

License & Privacy

MIT

Privacy Terms

Technical

Version

1.2.0Updated

June 9, 2021

Works with

Studio: 19.4.4 - 21.4.4

Certification

Silver Certified

Support

UiPath Community Support

Resources