Intelligent Credit Assessor - CREsselle

by russel alfeche

0

ML Model

<100

Summary

Summary

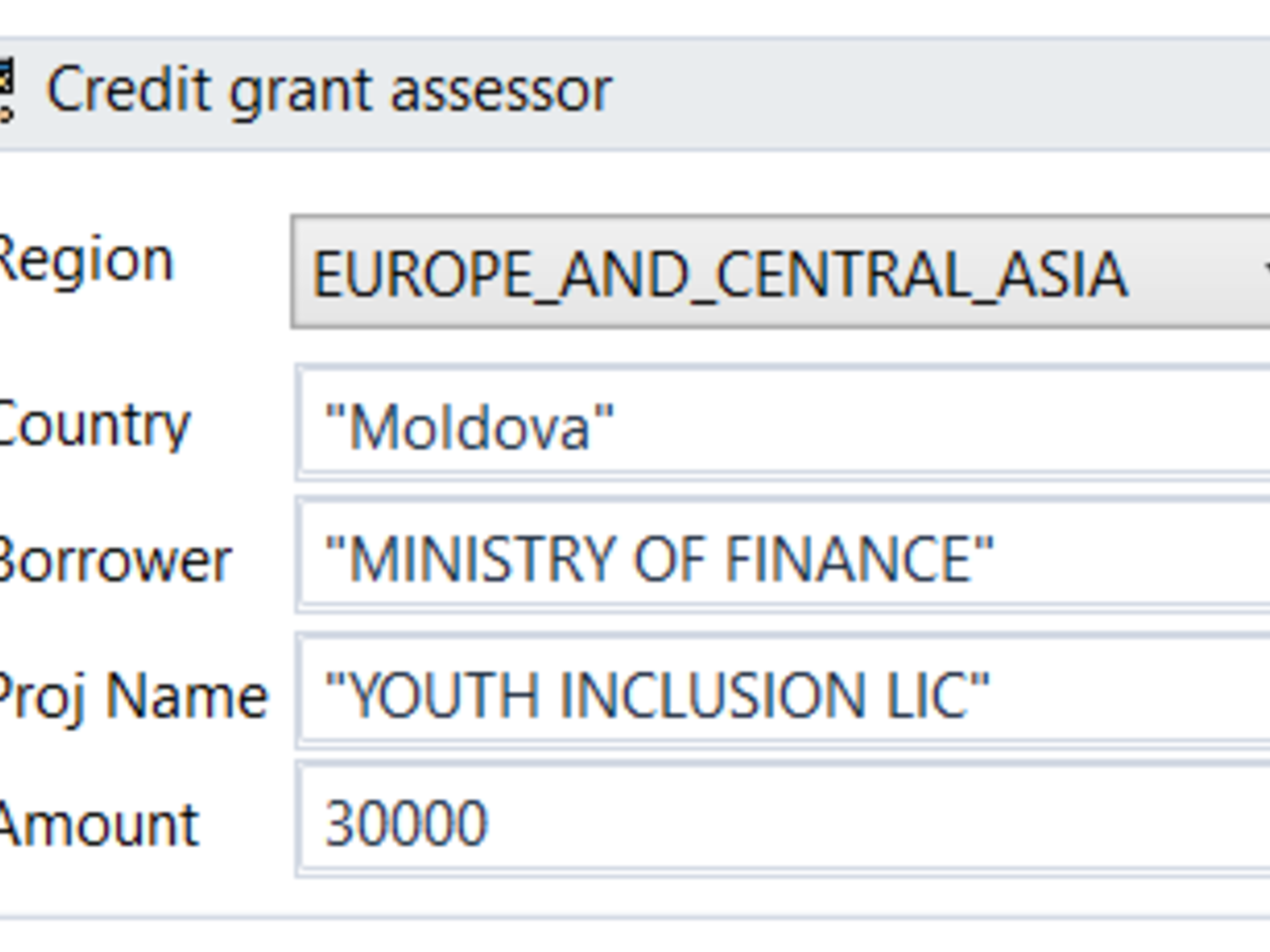

Pre-trained machine learning model to effectively assess credit grant requests that can be incorporated to automation.

Overview

Overview

This activity can be used to easily incorporate credit grant assessment into your automation.

Qualifying for the different types of credit hinges largely on your credit history. This activity boasts a pre-trained machine learning model which utilizes historical public credit data by world bank.

Given a set of credit request details (input parameters or features), it can predict if that particular credit request can be Approved or Rejected based on what it has learned from the historical training data.

Features

Features

Helping banks and other financial institutions to streamline their credit assessment processes making it more efficient, intelligent and future-proofed. It can also help individuals to maximize their approval odds. Credit Risk models play a key role in the assessment of two main risk drivers. 1) Willingness to pay and 2) Ability to pay. These two fundamental drivers need to be determined at the point of each application to allow the credit grantor to make a calculated decision based on repayment odds, which in turn determines if an applicant should get a loan, and if so - what the size, price and tenure of the offer will be. There are two types of risk models in general: New business risk, which would be used to assess the risk of application(s) associated with the first loan that he/she applies. The second is a repeat or behaviour risk model, in which case the customer has been a client and applies for a repeat loan. In the latter case - we will have additional performance on how he/she repaid their prior loans which we can incorporate into our risk model.

Additional Information

Additional Information

Dependencies

The project was built using the following technologies. Visual Studio with .NET Framework 4.6.1 Azure Machine Learning Studio - Multi-class neural Network